GET.invest rolls out Finance Readiness Support as part of its Finance Access Advisory

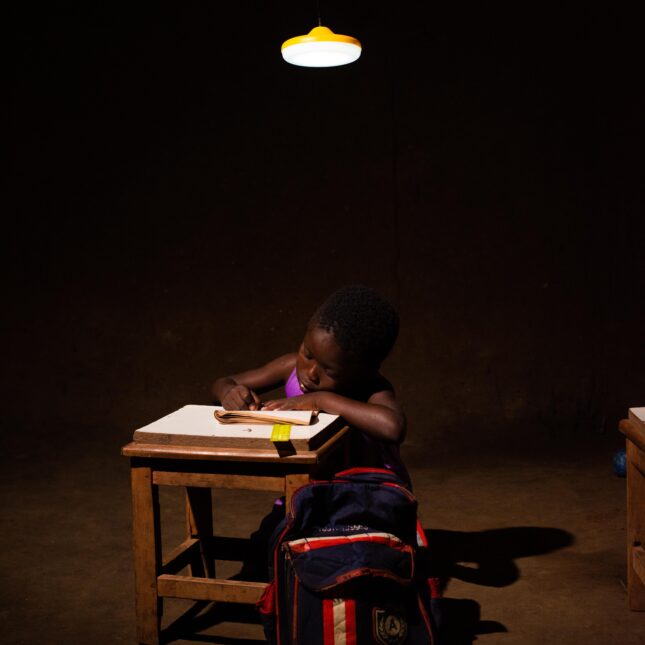

The GET.invest Finance Readiness Support was born out of the need to bridge the financing gap for locally-owned and managed energy access companies, particularly in sub-Saharan Africa. These companies often face challenges in accessing funding due to their small size, limited track record, and specific financing requirements. The facility aligns with GET.invest’s broader objective of achieving universal energy access and recognises the pivotal role that small and medium-sized enterprises (SMEs) play in building sustainable energy markets.

Complementing the Finance Catalyst as part of GET.invest’s Finance Access Advisory, the Finance Readiness Support focuses on micro-, small-, and medium-sized energy companies in their early stages. As such, the service, which was developed in close collaboration with core industry partners such as the Alliance for Rural Electrification (ARE), Clean Cooking Alliance (CCA), ENERGIA, Global Distributors Collective (GDC) and GOGLA, offers hands-on, in-depth business development advisory and coaching to assist entrepreneurs in preparing for their first formal investment.

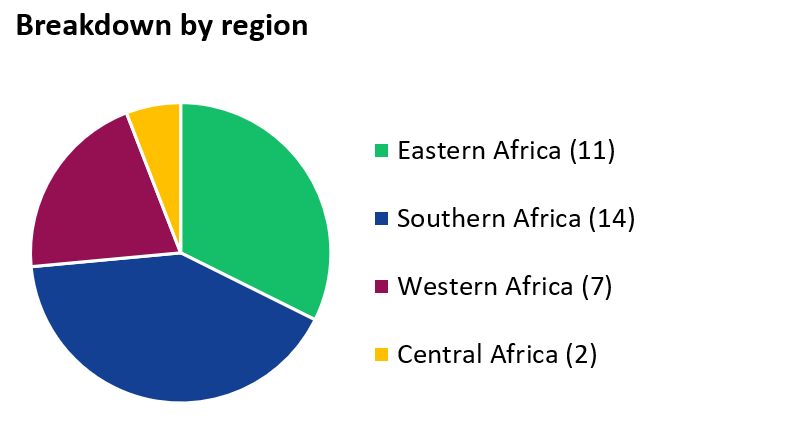

The pilot phase of the facility, initiated in November 2021, achieved significant milestones over the past two years. Throughout this period, 34 companies – the majority women-owned or -managed and from UN Least Developed Countries (LDCs) – received support tailored to their unique needs. Geographically diverse, the supported companies were spread across Sub-Saharan Africa. The cohort also covered diverse market segments, including energy-efficient appliances and productive use, stand-alone systems, mini-grids, e–mobility, clean cooking, and commercial & industrial applications.

As a result, 19 out of the 34 participating companies were successfully introduced to financiers. Eight companies already reached financial close, resulting in a total expected investment volume of EUR 10.3 million* across 15 transactions. At the conclusion of the pilot phase, all surveyed companies expressed their appreciation for the support received. Tracy Kimathi, Founder of Baridi, highlighted the benefits, stating that “through the GET.invest Finance Readiness Support, Baridi has been able to receive introductions to relevant industry debt and equity investors, refine grant applications, structure a Deal Room including key refined documentation.” The participating companies also acknowledged the quality and added value of the support. In the words of Francis Romano, CEO and Founder of Drive Electric: “Working with GET.invest’s Finance Readiness Support has been transformative for Drive Electric. Their invaluable assistance in honing our R&D capability and refining our financial models has positioned us for greater success.”

As a result, 19 out of the 34 participating companies were successfully introduced to financiers. Eight companies already reached financial close, resulting in a total expected investment volume of EUR 10.3 million* across 15 transactions. At the conclusion of the pilot phase, all surveyed companies expressed their appreciation for the support received. Tracy Kimathi, Founder of Baridi, highlighted the benefits, stating that “through the GET.invest Finance Readiness Support, Baridi has been able to receive introductions to relevant industry debt and equity investors, refine grant applications, structure a Deal Room including key refined documentation.” The participating companies also acknowledged the quality and added value of the support. In the words of Francis Romano, CEO and Founder of Drive Electric: “Working with GET.invest’s Finance Readiness Support has been transformative for Drive Electric. Their invaluable assistance in honing our R&D capability and refining our financial models has positioned us for greater success.”

Building upon the pilot’s successes and learnings, the roll-out phase now ensures a continued service offering to a larger number of energy access companies. Once again, the support will be delivered by eight leading consulting firms: Advance Consulting, Catalyst Energy Advisors, Energy 4 Impact (powered by Mercy Corps), GFA Consulting Group and I&P Conseil, GreenMax Capital Advisors, INENSUS, Open Capital, and Persistent.

Between 2024 and 2026, the GET.invest Finance Readiness Support will have the capacity to support up to 64 locally-owned and -managed companies, thereby expanding its impact. Companies interested in receiving support can now submit applications through the GET.invest website, with the application portal being open year-round.

*The numbers presented in this article are subject to change, as final results monitoring is currently being conducted.